Application Requirements

1. If an overseas-registered Chinese-capital controlled enterprise (“OCCE”) fits the description of being a resident enterprise, it shall file an application for identification of resident status to the tax authority at the place where its main investor in China is registered. The competent tax authority should conduct a preliminary assessment of the enterprise’s resident status before further submitting the application level by level to the provincial tax authority for confirmation. Such confirmation, after being made by the provincial tax authority, will be communicated to other investment related provincial tax authorities.

2. An OCCE that meets all the following conditions, shall be regarded as an Overseas-registered Chinese-capital controlled Tax Resident Enterprise (“Deemed Overseas TREs”) with its effective management located in China and thus the enterprise shall be subject to the corresponding enterprise income tax (EIT) administration on its income derived from sources inside and outside of China:

(1) The places where the senior management personnel and relevant departments in charge of the daily production, operation and management of the enterprise perform their duties are mainly located within the territory of China;

(2)Financial decisions (e.g., money borrowing, lending, financing and financial risk management) and human resources decisions (e.g., appointment, dismissal and remuneration) are made or need to be approved by organizations or personnel located within the territory of China;

(3) The main assets, accounting books, official seals, and minutes of board/shareholder meetings of the enterprise are located or preserved within the territory of China; and

(4) No less than 1/2 of the directors having voting rights or senior management personnel of the enterprise habitually reside in China.

3.The principle of “substance over form” should be used for the judgement on where the effective management body of the OCCE is located. An OCCE should conduct a self-assessment to determine if its effective management is located in China based on its actual production, operation and management.

Legal Basis

Circular of the State Taxation Administration on Issues Concerning the Identification of Overseas-registered Chinese-capital Controlled Enterprises as Tax Resident Enterprises based on Place of Effective Management (Guo Shui Fa [2009] No.82)

Article 7 and Article 8 of the Income Tax Administrative Measures for Overseas-registered Chinese-capital Controlled Tax Resident Enterprises (Trial) (issued by STA Public Notice [2011] No. 45 and amended by STA Public Notice [2015] No. 22 and STA Public Notice [2018] No. 31)

Materials Needed

Notes:

1. Taxpayers are responsible for the authenticity and legality of the materials submitted.

2. Taxpayers are required to submit paper documents when they go to the tax service hall to handle their tax affairs,or submit electronic documents according to the operation requirements of the online system if they handle their tax affairs online or through mobile terminals.

3. For materials not specified as original or printed copies in the “Materials Needed” list, the original copies shall be provided; for materials specified as printed copies, only printed copies shall be provided; for materials specified as original and printed copies, the printed copies will be collected and the original copies will be returned after verification.

4. The submitted printed copies must state its consistency with the original copies and be stamped with the company’s official seal.

Service Channels

1. Tax Service Halls (Click to view the location, opening hours and contact information of the tax service halls)

“City-wide Universal Processing” services are currently unavailable at all tax service halls.

2. Self-service tax terminal access is currently unavailable.

3. Online service

Currently there are no online services available for Resident Enterprise filing.

Processing Authority

The competent tax authorities

Processing Time

1. Time limit for taxpayers

N/A.

2. Time limit for tax authorities

Within 20 working days

Tel.

Please refer to the tax service map for contact numbers of each tax service hall.

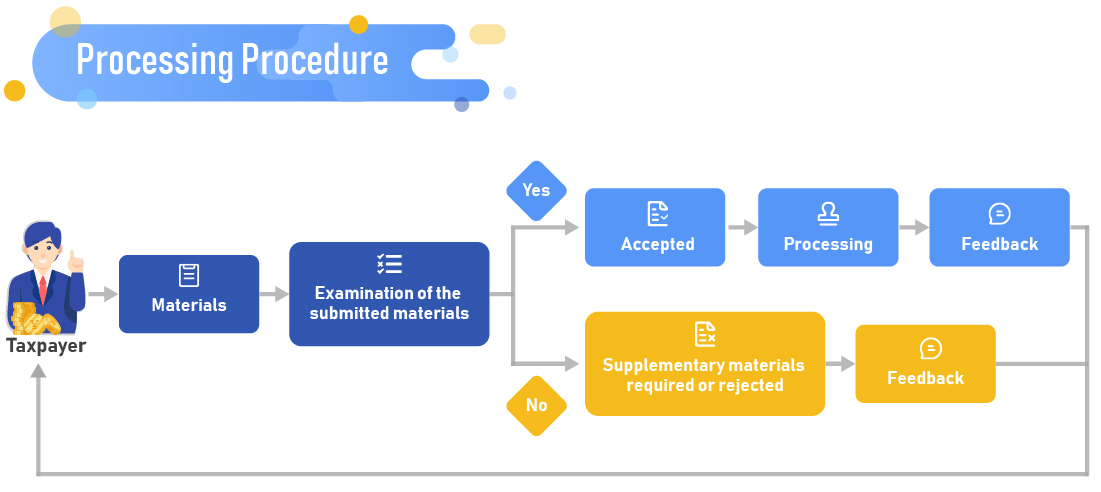

Processing Procedure

Processing Result

Tax authorities will give feedback on the Identification Letter of Overseas-registered Chinese-capital controlled Tax Resident Enterprise.

Notices for Taxpayers

1. Taxpayers are responsible for the authenticity and legality of the materials submitted.

2. The tax authorities provide single-window service. Taxpayers need to visit the tax authorities only once at most on the precondition that the materials are complete and meet the legal requirements for acceptance.

Fees

Free of charge

Application Forms

N/A.

Instructions for Filling out Forms

N/A.