深圳市财政局 深圳市商务局 国家税务总局深圳市税务局 中华人民共和国深圳海关 深圳市口岸办公室 深圳市文化广电旅游体育局关于离境退税事宜的公告(中英文版)

信息来源:深圳市财政局 信息提供日期:2025-07-24 15:39 【字体:大中小 】 视力保护色:

为推动离境退税提质增效,提升境外旅客入境消费便利性,打造全国离境退税标杆城市,按照《财政部关于实施境外旅客购物离境退税政策的公告》(财政部公告2015年第3号)、《商务部等6部门关于进一步优化离境退税政策扩大入境消费的通知》(商消费发〔2025〕84号)等规定,现对我市离境退税事宜公告如下:

一、离境退税政策

离境退税是指境外旅客离境时,对其在退税商店购买退税商品退还增值税的政策。

(一)境外旅客,是指在我国境内连续居住不超过183天的外国人和港澳台同胞。

(二)退税商品,是指由境外旅客本人在退税商店购买且符合退税条件的个人物品,但不包括下列物品:《中华人民共和国禁止、限制进出境物品表》所列的禁止、限制出境物品;退税商店销售的适用增值税免税政策的物品;财政部、海关总署、国家税务总局规定的其他物品。

(三)同一旅客同一日在同一商店购买退税物品金额达200元以上;商品尚未启用或消费;离境日距商品购买日不超过90天;所购商品由本人随身携带或随行托运出境。

(四)退税商品适用13%税率的,退税率为11%(含代理机构手续费);适用9%税率的,退税率为8%(含代理机构手续费)。

二、离境退税办理流程

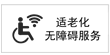

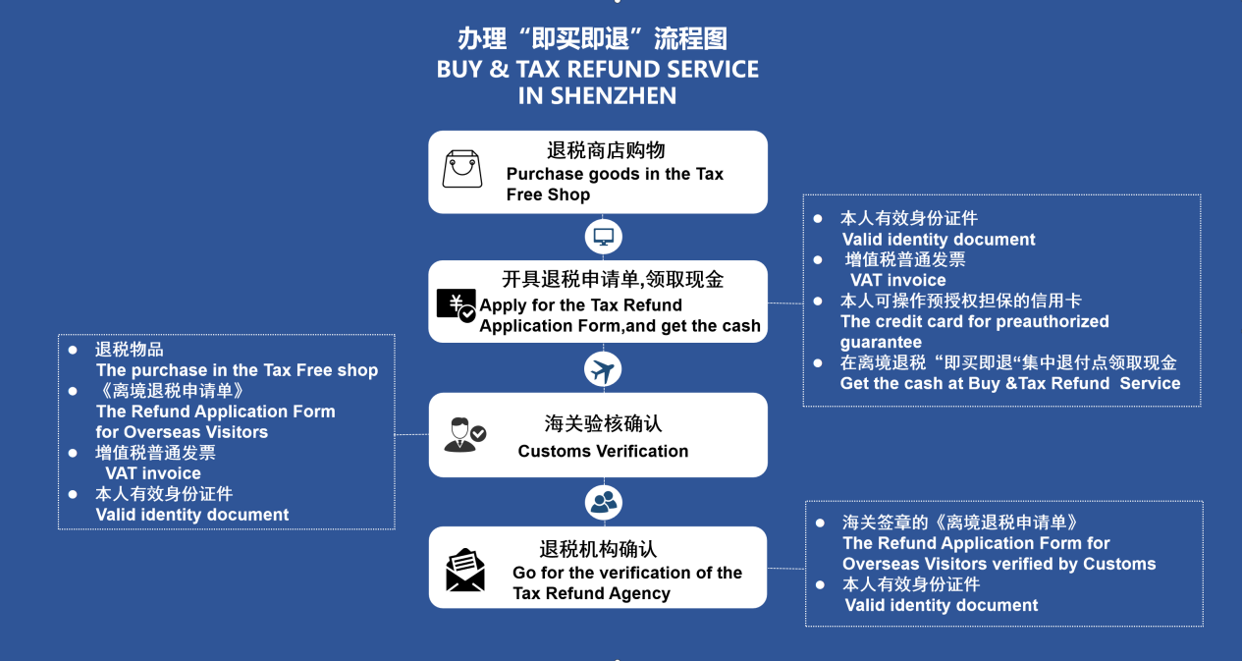

(一)离境退税办理流程

1.退税商店购物;

2.退税商店开具申请单;

3.海关验核确认;

4.退税代理机构退税。

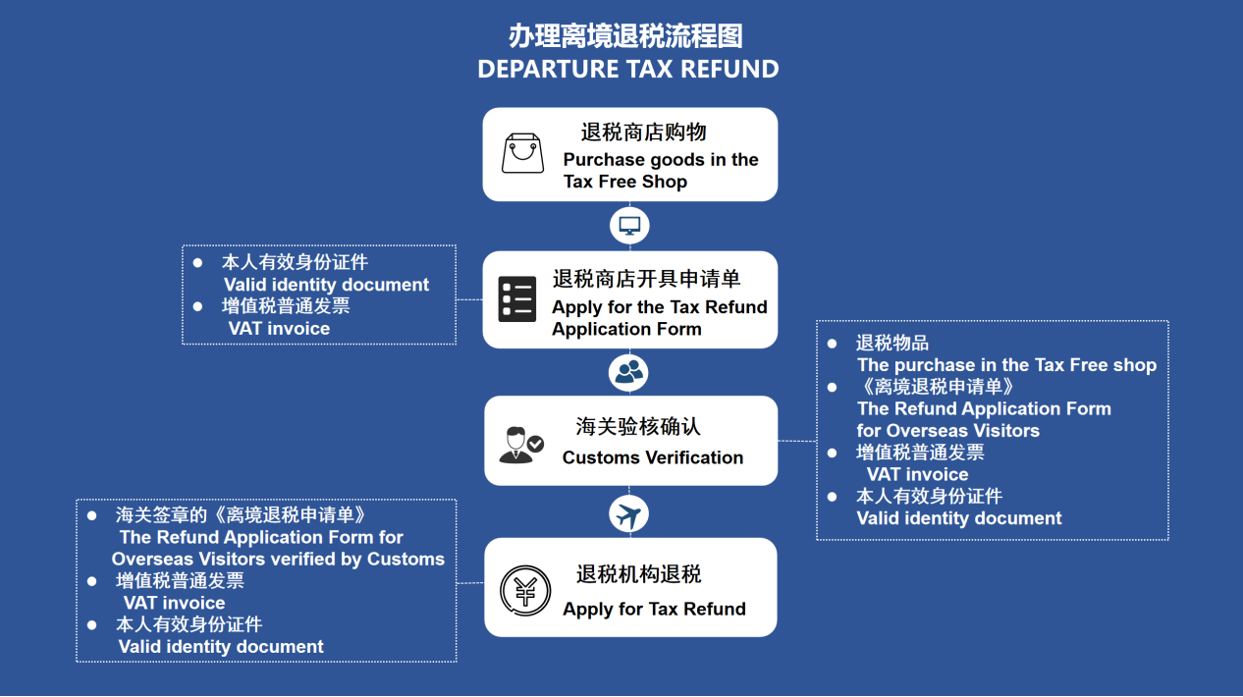

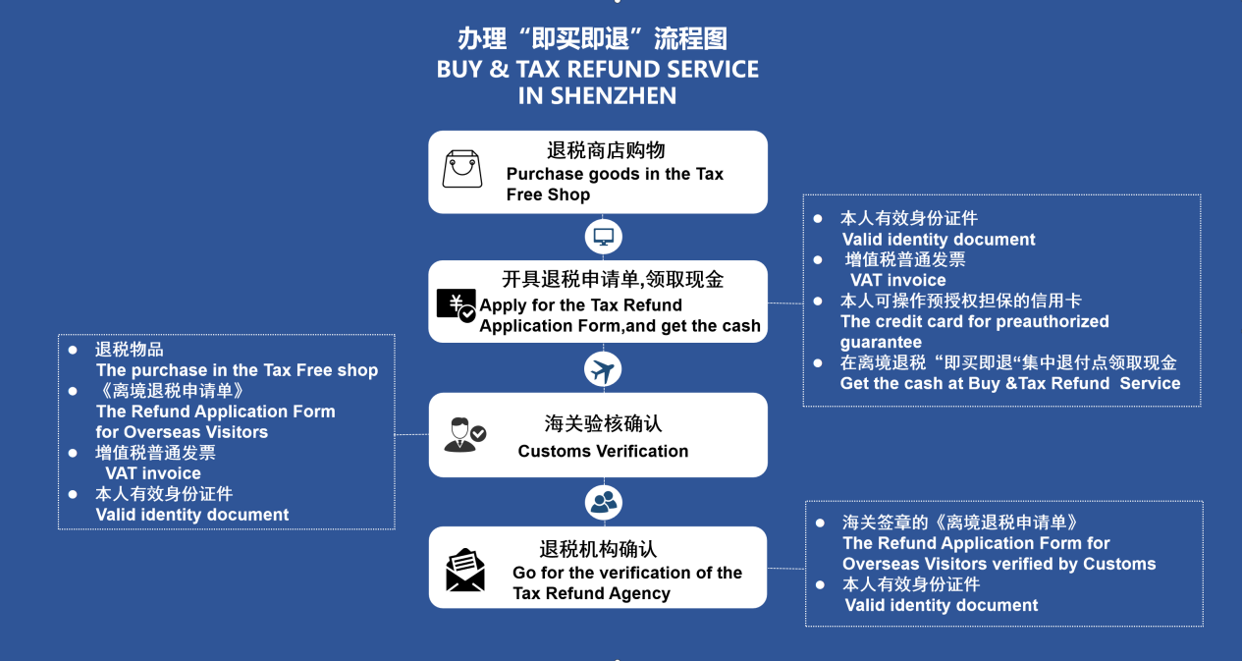

(二)离境退税“即买即退”办理流程

1.退税商店购物;

2.退税商店开具退税申请单,境外旅客领取现金;

3.海关验核确认;

4.退税代理机构确认。

三、离境退税商店、商圈和“即买即退”集中退付点

我市已开通1000多家离境退税商店,多个离境退税特色商圈,12个“即买即退”集中退付点,覆盖深圳特产、3C产品、服饰箱包、生活百货等,具体以国家税务总局深圳市税务局公布信息为准,查询渠道详见以下二维码。

四、离境退税口岸

现开通文锦渡口岸、福田口岸、深圳湾口岸、宝安国际机场、蛇口邮轮母港等5个离境退税口岸,办理业务时间均为星期一至星期日9:00-21:00,节假日办理业务时间以退税点公告为准。文锦渡口岸、深圳湾口岸仅在旅检通道设置离境退税点,供境外旅客办理离境退税业务。客运车道暂未设置离境退税点,无法向境外旅客提供离境退税业务办理。

(一)文锦渡口岸

1.地址:深圳市罗湖区沿河南路1188号

2.退税办理点:旅检大楼二层出境大厅西南角

(二)福田口岸

1.地址:深圳市福田区裕亨路23号

2.退税办理点:旅检大楼三层出境大厅东南角

(三)深圳湾口岸

1.地址:深圳市南山区东滨路1号

2.退税办理点:旅检大楼二层出境大厅西南角

(四)宝安国际机场

1.地址:深圳市宝安区宝安大道

2.退税办理点:国际出发大厅308-309登机口

(五)蛇口邮轮母港

1.地址:深圳市南山区海运路1号

2.退税办理点:二楼出境离境退税点

五、有关事项

(一)我市还将进一步增加离境退税商店、“即买即退”集中退付点、离境退税口岸,优化离境退税服务,具体情况将动态调整公告。

(二)我市已于4月27日,在金光华商场、深圳湾万象城、深圳万象城开展离境退税“一单一包”便利化模式试点,建议离境退税商店和境外旅客积极选择采用便利化模式。

(三)本公告未尽事宜,按照《财政部关于实施境外旅客购物离境退税政策的公告》(财政部公告2015年第3号)、《商务部等6部门关于进一步优化离境退税政策扩大入境消费的通知》(商消费发〔2025〕84号)等规定执行。

感谢对离境退税工作的支持与配合,欢迎提出宝贵建议。

本公告自发布之日起施行。

特此公告。

深圳市财政局 深圳市商务局

国家税务总局深圳市税务局 中华人民共和国深圳海关

深圳市口岸办公室 深圳市文化广电旅游体育局

2025年7月23日

Finance Bureau of Shenzhen Municipality • Commerce Bureau of Shenzhen Municipality • Shenzhen Tax Service, State Taxation Administration •Shenzhen Customs District P. R. China •Port Office of Shenzhen Municipal People's Government • Culture, Media, Tourism and Sports Bureau of Shenzhen Municipality Announcement on Tax Refund for Overseas Visitors

To enhance the efficiency of tax refund services for overseas visitors, improve convenience for inbound consumption, and establish Shenzhen as a national model city for tax refunds, in accordance with the Announcement of the Ministry of Finance on Implementing Tax Refund Policy for Overseas Visitors (MOF Announcement No. 3 [2015]) and the Notice of the Ministry of Commerce et al. on Further Optimizing Tax Refund Policies to Expand Inbound Consumption (SC Document No. 84 [2025]), matters regarding tax refunds for overseas visitors in Shenzhen are hereby announced as follows:

I. Tax Refund Policy

Tax refund for overseas visitors refers to the policy of refunding value-added tax (VAT) on goods purchased by overseas visitors from designated tax refund shops upon their departure from China.

1. Overseas Visitors refers to foreign nationals and compatriots from China's Hong Kong, Macao, and Taiwan regions who do not stay in Mainland of China for more than 183 consecutive days.

2. Tax Refund Articles

Refund articles refer to personal items purchased by overseas visitors themselves at tax refund stores that meet refund conditions, excluding:

Articles listed in the Prohibited and Restricted Articles for Exit and Entry of the People's Republic of China;

Items sold under VAT exemption policies at tax refund stores;

Other articles specified by the Ministry of Finance, General Administration of Customs, and State Taxation Administration.

3. Eligibility Requirements

To qualify for a tax refund:

Same-store single-day purchase amount must reach RMB 200 or more;

Goods must be unused and unconsumed;

Departure must occur within 90 days of purchase;

All purchased goods must be carried or checked in personally upon departure.

4. Refund Rates

For articles subject to 13% VAT rate: Refund rate is 11% (including agency service fees);

For articles subject to 9% VAT rate: Refund rate is 8% (including agency service fees).

II. Departure Tax Refund Procedures

(A) Departure Tax Refund Procedure:

(1) Purchase goods in the Tax Free Shop;

(2) Apply for the Tax Refund Application Form;

(3) Customs Verification;

(4) Apply for Tax Refund.

(B) Buy & Tax Refund Service in Shenzhen

(1) Purchase goods in the Tax Free Shop;

(2) Apply for the Tax Refund Application Form, and get the cash;

(3) Customs Verification;

(4) Go for the verification of the Tax Refund Agency.

III. Tax Refund Stores, Commercial Zones, and "Instant Refund" Centers

Shenzhen has over 1,000 designated tax refund stores, multiple tax refund commercial zones, and 12 "Instant Tax Refund" centers. These cover local specialties, 3C products, apparel, luggage, daily goods, etc. For specific details, refer to the latest information published by the Shenzhen Tax Service, State Taxation Administration (scan QR code below).

IV. Tax Refund Ports

Tax refund services are currently available at five designated ports: Man Kam To Control Point, Futian Port, Shenzhen Bay Port, Shenzhen Bao'an International Airport, and Shekou Cruise Home Port. Operating hours are Monday through Sunday from 9:00 to 21:00, while services during public holidays are subject to the notice issued by respective tax refund counters. At Man Kam To Control Point and Shenzhen Bay Port, tax refund counters are exclusively set up in Passenger Inspection Channels for processing refunds for overseas visitors; Vehicle Channels currently have no tax refund counters, thus the service cannot be provided to passengers departing via road transport.

(A) Man Kam To Control Point

1. Address: No. 1188 Yanhe South Road, Luohu District

2. Location: Southwest corner, 2/F Departure Hall

(B) Futian Port

1. Address: No. 23 Yuheng Road, Futian District

2. Location: Southeast corner, 3/F Departure Hall

(C) Shenzhen Bay Port

1. Address: No. 1 Dongbin Road, Nanshan District

2. Location: Southwest corner, 2/F Departure Hall

(D) Shenzhen Bao'an International Airport

1. Address: Bao'an Avenue, Bao'an District

2. Location: Gates 308-309, International Departures Hall

(E) Shekou Cruise Home Port

1. Address: No. 1 Haiyun Road, Nanshan District

2. Location: 2/F Departure Tax Refund Counter

V. Supplementary Matters

(1) Shenzhen will further expand the network of tax refund stores, "Instant Tax Refund" centralized refund points, and designated tax refund ports, while optimizing tax refund services. Specific arrangements will be dynamically updated through official announcements.

(2) Shenzhen launched the pilot program for the 'Single Form & Single Package' Facilitation Service at King Glory Plaza, Shenzhen Bay MixC, and Shenzhen MixC on April 27, 2025. Tax refund stores and overseas visitors are encouraged to actively adopt this service.

(3) For matters not covered herein, refer to:Announcement of the Ministry of Finance on Implementing Tax Refund Policy for Overseas Visitors (MOF Announcement No. 3 [2015]);Notice of the Ministry of Commerce et al. on Further Optimizing Tax Refund Policies to Expand Inbound Consumption (SC Document No. 84 [2025]).

We appreciate your support and cooperation in tax refund operations. Valuable suggestions are welcome.

This Announcement takes effect immediately.

HEREBY ANNOUNCED.

Finance Bureau of Shenzhen Municipality

Commerce Bureau of Shenzhen Municipality

Shenzhen Tax Service, State Taxation Administration

Shenzhen Customs District P. R. China

Port Office of Shenzhen Municipal People's Government

Culture, Media, Tourism and Sports Bureau of Shenzhen Municipality

23rd July 2025

粤公网安备 44030402001126号

粤公网安备 44030402001126号